Each month, Queen Street Analytics publishes four reports on the government relations landscape in Ottawa, analyzing noteworthy patterns across (#1) the most lobbying-active sectors and organizations, (#2) the most lobbied government institutions and public officials (DPOHs), (#3) the most active lobby-firms and lobbyist-consultants, and (#4) the most lobbied-on and discussed subjects, themes, issues and topics. Our approach is not journalistic and we don’t report on anecdotes or on the news cycle. Instead, we use statistical and machine-learning enabled analytics to uncover patterns, trends, and opportunities, giving our subscribers an enhanced toolkit to navigate the government relations landscape. Check out our other September newsletters here:

In our fourth newsletter of the month we analyze the subjects, themes, issues and topics that drove lobbying and government discussions in August.1 Subjects, themes, issues, and topics are squishy words, but in this newsletter they have specific meaning: official “subjects” are a set of 54 labels attached to each lobby-communication when filed. They are stable and easy to interpret but also broad and generic. In contrast, “TFIDF themes” are generated by running machine-learning algorithms over communication text descriptions to extract the key-phrases that describe these meetings. Themes are much more fine-grained than subjects, and often vary a lot over time even within a sector or institution. Finally, there are 2000+ “topics” that government services tag onto the text records of the parliamentary Hansard and the meeting-minutes of each committee, and the LobbyIQ data we use aggregates those into just over 100 bigger “issues” (e.g. aggregating the topics of “nuclear waste storage,” “modular reactors,” and “nuclear energy” into a single “nuclear” issue). For a primer on these concepts, check out our separate post here.

Today’s newsletter focuses on the themes and subjects that stood out in August’s lobbying communications. Parliament was not in session in August so there are no issues or topics to analyze.2

The CliffsNotes version:

The most lobbied-on TFIDF themes in August included the Environmental Protection Act, Environmental Assessment Act, the Broadcasting Act, and the Clean Hydrogen Investment Tax Credit, among about a dozen other acts and policy initiatives

The 10+ biggest break-outs from trend among theme-sector pairs included chemical manufacturers’ lobbying on the Environmental Assessment Act, pension funds’ lobbying on Federal Investment Regulations, and fisheries lobbying on a new Aquaculture Development Strategy.

The most lobbied-on subjects in August included Economic Development, Environment, Industry, Energy, Budget, and Agriculture

Across subject matters, the biggest break-outs from trend in August were International Trade, Telecommunications and Housing, none of which are in the usual top-10 of lobbied-on subject matters

Among subject-sector pairs, break-outs from trend included power generation companies lobbying more on Climate, environmental groups lobbying less on Environment, and trucking companies lobbying less on Transportation. (In the latter two, this mostly meant less lobbying altogether in August by these sectors.)

1. Last Month’s Noteworthy TFIDF Lobbying Themes

Exhibit 1 shows the top-16 TFIDF themes last month. Nine of these refer to specific policies and laws, including the Canadian Environmental Protection Act, Canadian Environmental Assessment Act, Broadcasting Act, Greenhouse Gas Pollution Pricing Act, Canadian Aviation Regulations, Canadian Energy Regulator Act, Clean Hydrogen Investment Tax Credit, Softwood Lumber Agreement (and Federal Investment Regulations).

And five refer to specific government institutions and initiatives, including Canadian Food Inspection Agency, Global Affairs Canada, Canadian Agricultural Partnership, National Housing Strategy, and the Canada Deposit Insurance Corporation.

The way to interpret this list is that the Count-column gives the total number of sectors in which a theme was central in explaining lobbying communications in August, the TFIDF-column shows the aggregate centrality score of a theme summed over sectors, and TF shows the total frequency of mentions of a theme across lobbying text-descriptions in which it was central. (TFIDF and TF are uncorrelated because key phrases that generally appear more often (higher TF) are often also less meaningful for characterizing a text.)

2. Noteworthy Subject-Sector Pairs in TFIDF Themes

To hone in more specifically on breakout themes we focus on theme-sector pairs and run a prediction model of how central themes are expected to be for a sector, based on the previous twelve months of data. Exhibit 2 shows the clearest outliers in theme-sector pairs in August, where the TFIDF-column measures a theme’s centrality to describing a sector’s lobbying communications, and the Excess-column measures the deviation from trend in this number for a theme-sector pair.

LobbyIQ’s sector-dashboards often enable subscribers to quickly infer the underlying reason for these breakout theme-sector pairs. For example, a look at LobbyIQ’s sector-dashboard for chemical manufacturing explains chemical manufacturers’ unusual focus on the Canadian Environmental Assessment Act and the Canadian Environmental Protection Act in their lobby communications last month. LobbyIQ’s overview of recent communications in the sector shows a sizable increase in lobbying by Dow Chemical Canada, and a look at the two underlying registrations reveals that these communications are heavily focused on the Environmental Assessment and Environmental Protection Acts.

3. Last Month’s Dominant Lobbying Subjects

To measure “break-out” communications-activity across 54 possible subjects, we use a monthly database of all communications since December 2015 (the beginning of the Trudeau government), and estimate a model that projects the number of communications by subject-month pair onto a time-polynomial, calendar-month shifters (twelve per year to allow for widespread fluctuations in communications activity, e.g. during peak-Covid), as well as 54x12 subject-specific cyclical adjustment terms (to allow subject-specific seasonal fluctuations, for example because some subjects are prevalent in communications with MPs, who are out of session in summer). Exhibit 3 shows the top-20 subjects by lobby communications in July, with the number of associated meetings in the first column, and the deviations from what our model predicted in the second column.

Among the most lobbied subjects, several were actually less lobbied than predicted (with a negative Excess-column). But there are also several among the highly-lobbied subjects that did see minor breakouts relative to our prediction model, including including International Trade, Telecommunications and Housing for instance.

4. Noteworthy Subject-Sector Pairs and Subject-Sector-Institution Triples

Knowing that a subject sees unusually high communications activity leads to more actionable insights if we know the source of the communications, which means we want to look at subject-sector pairs. To get at subject-sector pairs, we expand the initial dataset of 4,968 subjects-months observations (54 subjects x 92 months) into a dataset with over 350,000 industry-subject-month observations (with 3,887 industry-subject pairs in the data).

Exhibit 4 shows the most heavily lobbied subjects and the top associated subject-sector pairs. For example, there were overall 133 communication filings in August with Climate as a subject (in rows 17-18 of the exhibit). This was 34 more than predicted, and two-thirds of this excess was driven by power generation and oil and gas companies. Environment, in contrast, saw 51 lobby communications fewer than predicted in rows 12-14, and this drop was largely due to environmental groups and oil and gas companies filing fewer communications on those subjects.

Knowing that a subject-sector pair saw deviations from trend in lobbying communications leads to more actionable insights if we know the target institution of these communications, which means we want to look at subject-sector-institutions triples. For each subject in Exhibit 4, we pick the top subject-sector pair, and break this out by the most lobbied institutions. Exhibit 5 shows that, for example, more than half of the 26 communications on “Economic Development” by the telecomms sector occurred with ISED.

Subscribers who want to take a more detailed dive into these data are referred to LobbyIQ’s custom query features.

5. Most Discussed Issues in Parliament

The third text-analytic metric we investigate in each month’s newsletter#4 is issues and tagged topics discussed on the parliamentary floor and in the House of Commons committees. With parliament not in session in August, there is nothing to report on this metric in this month’s edition of our newsletter#4.

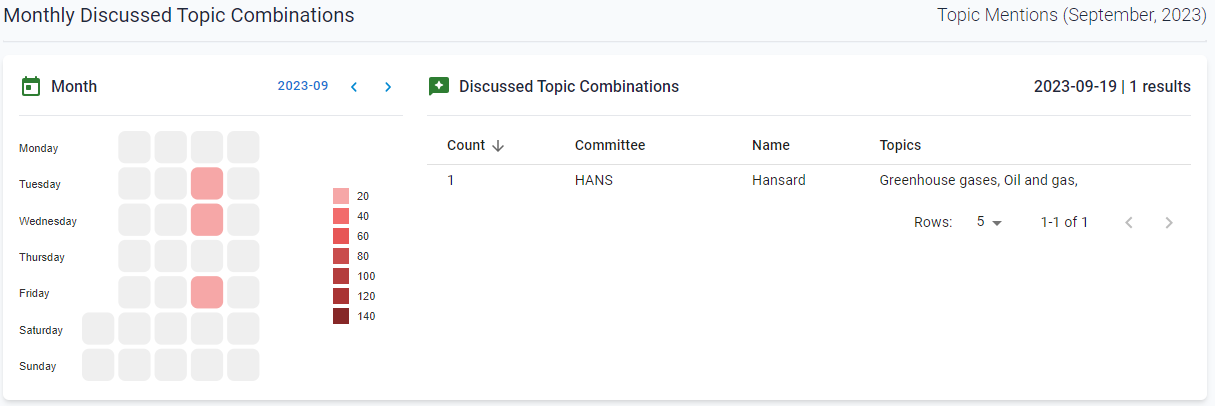

A slight trickle of parliamentary discussions has only just resumed: Exhibit 6 shows on LobbyIQ’s oil and gas issues-dashboard for September 2023, with, e.g., only three quotes related to oil and gas over the week of September 18th to 22nd. So we will get to have a look at what issues the government is talking about in the next edition of newsletter#4 on October 28th.

This newsletter #4 concludes our first month of regular weekly newsletters. If you enjoyed this first month, please subscribe and share.

Going forward, we plan to stick to the same general monthly cycle and topical structure for this newsletter, although the specific content is sure to go through changes based on subscriber requests and feedback.

Next week, it is time for October’s newsletter #1 covering August’s most lobbying-active sectors and organizations.

Lobbying communication filings need to be reported to the government by the 15th of the next month. Civil servants then take a few days to enter those filings into the public record. By the end of a month, the previous month’s filings are approximately complete. Given this cadence, Queen Street Analytics’ first 3 newsletters in September (published around the 7th, 14th, and 21st) treat July data as the “last month”, and the 4th newsletter (published around the 28th) treats August data as the “last month”. Restated, the data landscape for August is analyzed in September’s newsletter #4 plus October’s newsletters #1-#3.

Except that no issues had a chance to stand out last month because parliament was not in session.