Each month, Queen Street Analytics publishes four reports on the government relations landscape in Ottawa, analyzing noteworthy patterns across (#1) the most lobbying-active sectors and organizations, (#2) the most lobbied government institutions and public officials (DPOHs), (#3) the most active lobby-firms and lobbyist-consultants, and (#4) the most lobbied-on and discussed subjects, themes, issues and topics. Our approach is not journalistic and we don’t report on anecdotes or on the news cycle. Instead, we use statistical and machine-learning enabled analytics to uncover patterns, trends, and opportunities, giving our subscribers an enhanced toolkit to navigate the government relations landscape.

It’s September 21st, and our newsletter#3 for the month provides an analysis of who were Ottawa’s most active consultant lobbying firms last month.1 But first, we start with two big-picture questions: which sectors hire consultants instead of doing their own lobbying, and how concentrated is Ottawa’s lobbying industry overall when we apply standard metrics of industry concentration?

The CliffsNotes version:

there is big dispersion across sectors in who hires consultant lobbyists. the two likely explanations for this dispersion have different go-to-market implications

Ottawa’s consultant lobby firm industry is not very concentrated and trending towards becoming even less concentrated

six big firms with unusually high meetings activity, incl. Crestview Strategy, PAA Advisory and Prospectus Associates

six big firms with unusually low meetings activity, incl. Temple Scott, Sussex Strategy, and Counsel Public Affairs.

StrategyCorp and PAA Advisory had the highest number of new registrations

1. Who Hires External Consultant Lobbyists?

What types of sectors and organizations hires external consultant lobbyists? Let’s start with the big picture: Exhibit 1 shows the share of all lobbying communications in Ottawa that is done with the help of external consultants, as opposed to being handled in house by (potential) clients. This share was steadily increasing from 2011 to 2022 (blue dots), indicating that lobby firms have become overall more successful in communicating their value proposition to potential clients.

Somewhat concerningly, that share has dipped most recently in the first seven months of 2023 (red triangles). Although there is not yet enough data to call this a trend-break, it is a phenomenon we will take a deeper dive into in a future issue.

For now, let’s take a closer look at the cross-sectional dispersion in this consultant-utilization share across sectors for the first seven months of 2023. Exhibit 2 shows that there is indeed substantial variation in this share.

Further, Exhibit 2 shows a negative correlation between the amount of lobbying a sector does and the share it does with external consultants: sectors with the highest lobbying activity do most of their lobbying in-house. The strength of this statistical relationship is measured by its coefficient of correlation, which in this case is -.25 (and always fall inside a theoretical range from -1 to +1).

There are two main candidate explanations for this negative correlation: the first explanation is that organizations which routinely lobby are more likely to invest into developing the relevant capacity and relationships internally; the second explanation is that organizations that have less free cash flow to allocate to lobbying are more likely to use in-house lobbying, and because additional meetings are cheaper when lobbying is done in-house, they do more of them.

Anecdotally, the telecommunications sector’s position in Exhibit 2 fits better with the first story, while the universities sector and environmental groups fit better with the second story.

It matters which of the two stories explains a sector’s low engagement with external lobbyists, because the two stories have different strategic implications for a consultant firm looking to gain clients in any sector in the lower half of Exhibit 2. In the first story, price is less of a factor, and any consultant lobbyist’s value proposition needs to be centered around their unique access or their unique communications strategy. In the second story, potential clients are likely to be more cost-sensitive, and gaining market share likely has to involve a smart fee-differentiation strategy on the part of the consultant lobbyist.

There are also potentially interesting opportunities in the densely populated bottom-left of Exhibit 2, where firms engage in only a small amount of lobbying meetings, but keep them entirely in-house. Those sectors are likely to be cost-sensitive but also quite receptive to the communications capabilities that a professional consultant lobby firm brings to the table. In this corner, there is potential for both greater engagement with consultant lobbying firms and for greater engagement with government relations in general.

An interesting related question is which sectors have seen the most compositional changes in lobbying, i.e. have seen the share of lobbying done by external consultants trend upwards or downwards over recent times. Queen Street Analytics will take a deeper dive into this question in one of the next issues, but for now we move on to our second big-picture question.

2. How Concentrated is Ottawa’s Lobbying Industry?

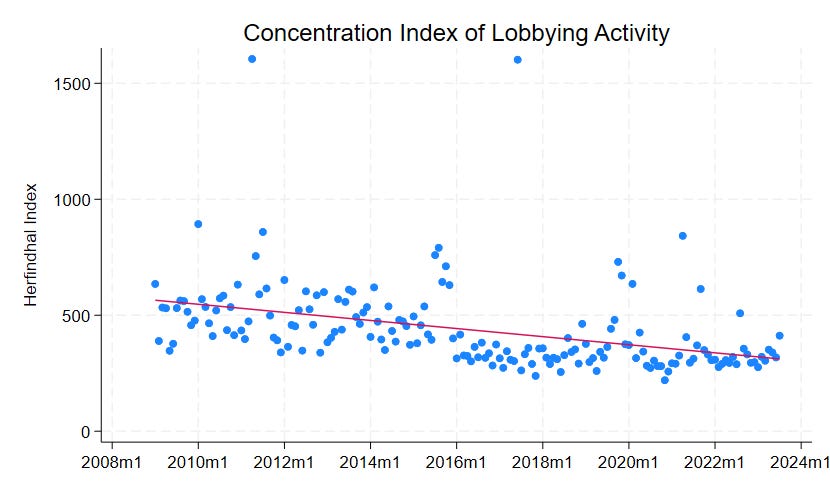

How concentrated is Ottawa’s lobbying industry? This question matters for large established players, but also for any GR professionals thinking of opening up a more boutique consultant firm. The classic way to answer the question of market concentration is with a Herfindahl–Hirschman index (HHI). This index sums up the squared market-shares of all players in a market. HHI has a theoretical maximum of 10,000 (= 100% x 100% for a pure monopoly), and antitrust authorities typically view markets with an HHI in the 1,500 to 2,500 points range with some concern, and markets with an HHI above 2,500 points as potentially justifying regulatory intervention.

Observing Sussex Strategy’s recent acquisition of Cumberland Strategies, one might feel the industry is getting more concentrated. On the other hand, there are always new boutique firms starting up, as we saw with KAN Strategies just this month.

So, how concentrated is the market for lobbying in Ottawa really? Exhibit 3 shows that not only is the market for lobby-firms not particularly concentrated from a traditional HHI-perspective, it is actually trending towards becoming less concentrated over time, from an average HHI in 2010 of 547 to an average HHI of just 331 in 2023.

This is encouraging news for smaller consultancy firms (and possibly the industry as a whole), and for any consultant who are considering striking out on their own.

An important unanswered question in this regard is the survival or churn rate of smaller consultancy firms once they open up; i.e. what are the near- and long-term chances of survival for newly founded boutique consultant lobby firms. Econometric tools like survival analysis or duration analysis offer solid approaches to answering this question, and we may take a stab at it in a future newsletter.

3. Most Active Lobby Firms in July 2023

With those two big-picture questions out of the way, we move on to newsletter#3’s core focus: which lobby firms were the most active in July in terms of taking meetings with public office holders (DPOHs)? Exhibit 4 shows the picture that emerges when we aggregate all July 2023 lobby communications up by consulting firm. The busiest firms (when it comes to meetings with public office holders) were Crestview Strategy, PAA Advisory, Capital Hill Group, Prospectus Associates and David Pratt & Associates. While all five of these are among the top-twenty or so firms in Ottawa in general, they did all have a higher-than-usual number of meetings in July, which pushed them to the top of the list. This is shown in the exhibit’s last column “ExcessM,” which measures the excess amount of meetings relative to a prediction model based on each firms’ average plus monthly (seasonal) adjustments terms. The other two columns show the number of meetings and the number of registrations these were associated with.

Exhibit 4 also shows that some of the other big established consultant firms had an unusually quiet month in July (i.e. a negative ExcessM), which naturally placed them further down on the July meeting-rankings. Among those are many big firms like Hill+Knowlton, Temple Scott Associates, Sussex Strategy Group, Global Public Affairs, NATIONAL Public Relations, and Counsel Public Affairs.

It is important to note that Exhibit 4 should not be interpreted as anything other than a description of last month’ activity. Month-to-month variation in lobby meetings can be driven by a wide range of factors including DPOHs’ calendars and clients’ strategic objectives.

4. New Lobby Registrations in July 2023

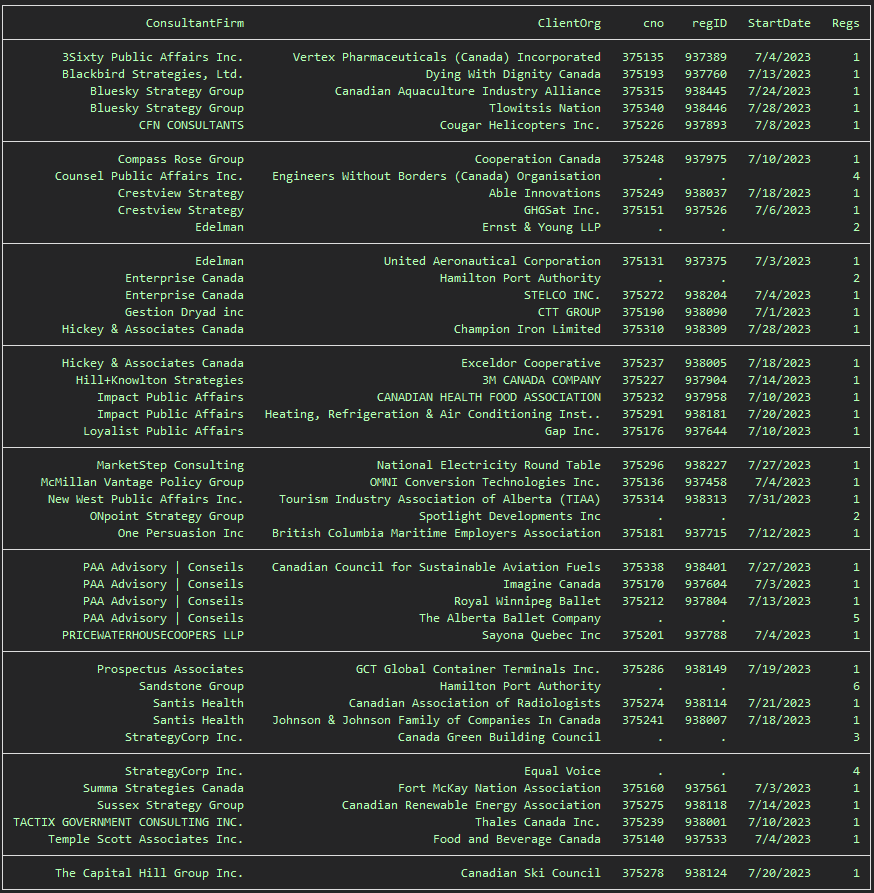

Lastly, we have a look at which lobby firms were the most active in July 2023 in terms of engaging and registering new clients. On this front, PAA Advisory led the charge in July, registering 4 of the 41 new partnerships listed in Exhibit 5.

Technical note on Exhibit 5: the last column displays the number of new registrations underlying each engagement; entries with Regs>1 indicate that more than one individual consultant a registration in relation to a new engagement. (Registrations can be looked up by typing the registrations’ “cno” and “regID” numbers into a stable url. For example, the url for the first entry in the exhibit is https://lobbycanada.gc.ca/app/secure/ocl/lrs/do/vwRg?cno=375135®Id=937389 ).

For engagements with more than one associated registrations, Exhibit 6 breaks out the underlying individual registrations for the interested reader, with their cno and regID numbers. (For example, the 14th registration listed on Exhibit is populated by https://lobbycanada.gc.ca/app/secure/ocl/lrs/do/vwRg?cno=375243®Id=938010 ).

Please subscribe and share if you enjoy this newsletter.

In next week’s fourth and last monthly newsletter for September, we take a closer look at some machine-learning enabled text analytics on lobby meetings’ subject matters, "hidden themes" uncovered through a method called TFIDF, and the most discussed issues that drove government-internal discussions in Ottawa last month.

Readers who want to take a more detailed dive into the data underlying our analytics can do so at LobbyIQ.

The lobby filings take about one month before they are close-to-completely reported, so that September is the earliest month to provide a reliable picture of July, October for August etc.