Each month, Queen Street Analytics publishes four reports on the government relations landscape in Ottawa, analyzing noteworthy patterns across (#1) the most lobbying-active sectors and organizations, (#2) the most lobbied government institutions and public officials (DPOHs), (#3) the most active lobby-firms and lobbyist-consultants, and (#4) the most lobbied-on and discussed subjects, themes, issues and topics. Our approach is not journalistic and we don’t report on anecdotes or on the news cycle. Instead, we use statistical and machine-learning enabled analytics to uncover patterns, trends, and opportunities, to allow our subscribers to better navigate the government relations landscape.

It is October 4th, and in today’s newsletter#1, we focus on which sectors and which organizations stood out in their lobbying activity during the month of August.1

The CliffsNotes:

There were close to 1,300 communications filings in August. This is around 400 below predicted; making August a slow month in historical perspective

Electric power generation, chemical manufacturing, and aerospace manufacturing were among the twelve sectors with unusually high lobbying communications activity last month

Construction was one of two sectors with unexpectedly low lobbying activity

In nine of the twelve sectors, August’s unusually high lobbying can be explained by focused lobbying campaigns by just one or two organizations

Overall, there were 14 breakout lobbying communications campaigns last month, including Telesat Canada in the Telecommunications sector, Air Products Canada Ltd in the Chemical manufacturing sector, and Huu-Ay-Aht First Nation, an Indigenous interest group.

You can check out last month’s newsletter#1 here:

1. Which Sectors Saw Unexpected Lobbying Activity in August 2023?

August saw almost 1,300 communications filings, which is about 400 lower than predicted by a simple model that predicts total filings with linear trends and calendar-month cyclical shifters. Behind this low aggregate figure, there were nonetheless several sectors which saw unusually high lobbying activity.

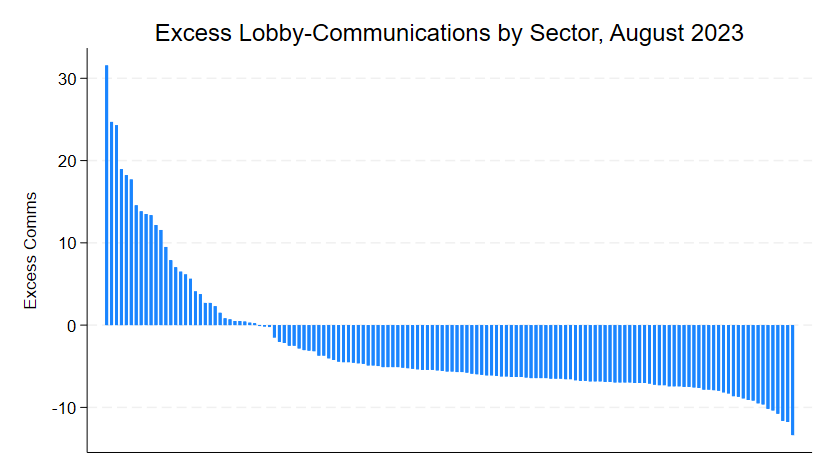

To identify these breakout sectors, we expand into a dataset that aggregates filings by sector-month, and run the same prediction model, with a separate shifter for each sector (creating a panel of 148 monthly-frequency time-series). Exhibit 1 charts the difference between actual and predicted number of filings in August, rank-ordered across the 148 sectors. The biggest positive breakout is +31 more communication filings than predicted (far left), the biggest negative one is -13 (far right).

There are 12 sectors with unexpectedly high lobbying (Excess - Comms > 12 ), and two with unexpectedly low lobbying (Excess - Comms < -12).

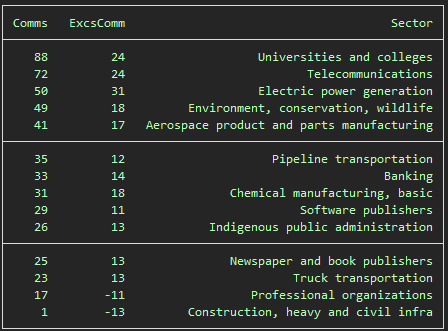

Exhibit 2 lists these outliers: the biggest three outliers in relative terms (i.e. Excess / Communications) are: electric power generation (31/50), chemical manufacturing (18/31), and aerospace manufacturing (17/41). The others are: universities, telecommunications, pipeline transportation, indigenous public administration groups, newspapers, truck transportation, banking, environmental groups, and software publishers.

Oftentimes, breakout lobbying in a sector is driven by the focused lobbying campaigns of just one or two organizations in that sector. In fact, it turns out that in August, nine of the twelve breakout sectors in Exhibit 2 are driven by this, and only Banking, Environmental groups, and Software publishers are not.

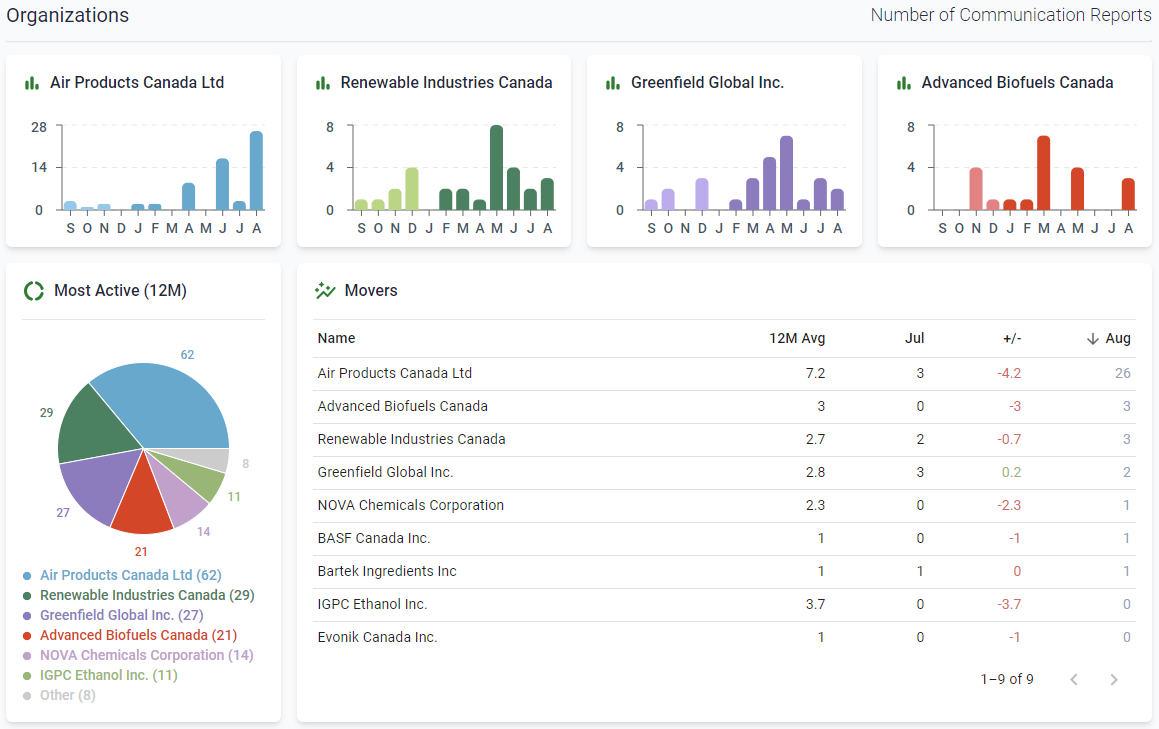

The organization clusters on LobbyIQ’s sector-dashboards provide the quickest gauge for flagging breakout lobbying campaigns by organizations within a sector. For example, Exhibit 3 shows the organization-cluster on LobbyIQ’s Chemical manufacturing dashboard where we can see that this sector’s +18 excess in communications in Exhibit 2 are fully accounted for by Air Products Canada Ltd, which filed 26 communication reports for August, which is 19 more than their twelve-month average of 7.2.

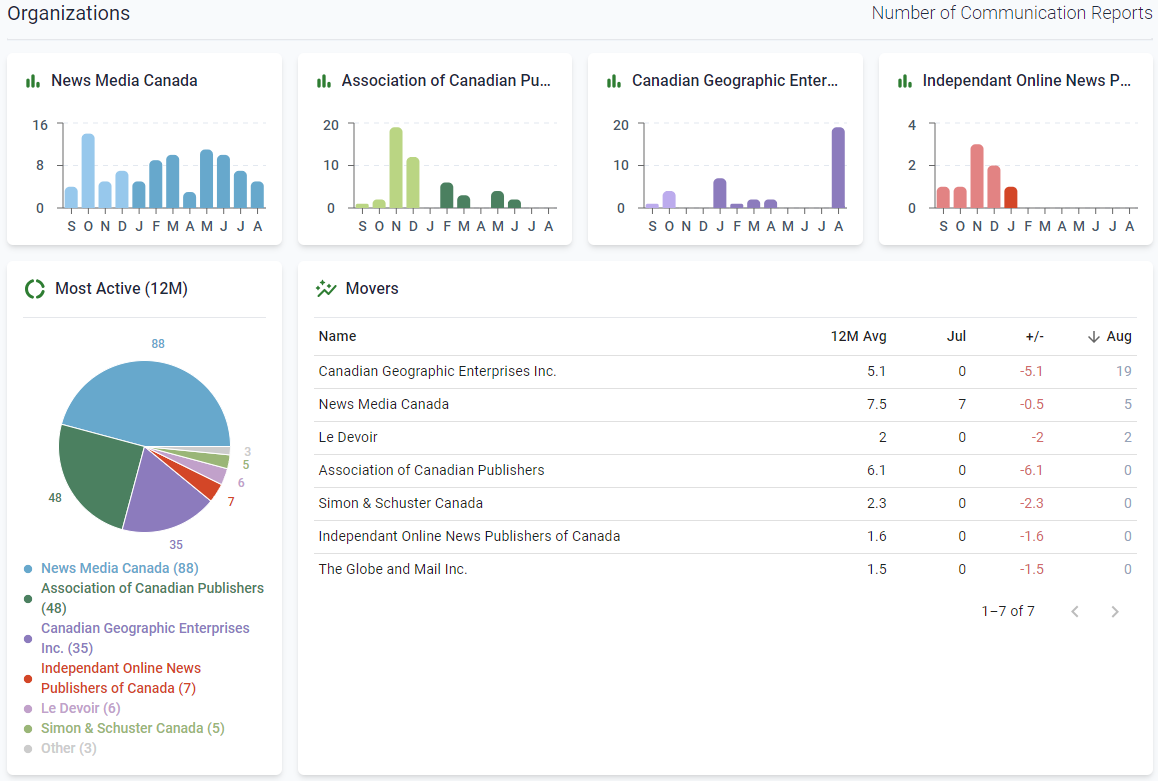

Similarly, Exhibit 4 shows the organization-cluster on LobbyIQ’s Newspaper and book publisher dashboard where we can see that this sector’s +13 excess in communications in Exhibit 2 can be fully accounted for by Canadian Geographic Enterprises Inc., which filed 19 communication reports for August, 14 more than their twelve-month average of 5.1.

2. Which Organizations Pursued Focused Lobbying Campaigns in August 2023?

To be more systematic in identifying what may be focused lobbying campaigns by individual organizations, we fan the communications-data out again into a panel comprised of several thousand organization-specific monthly series, and looking for August’s breakouts from the predicted number of communications at the organization-level.

We find that of the 12 sectors with unexpectedly high communications in August (Exhibit 2), nine can be associated with a focused lobbying campaign by a single organization (or two organizations in the case of universities).

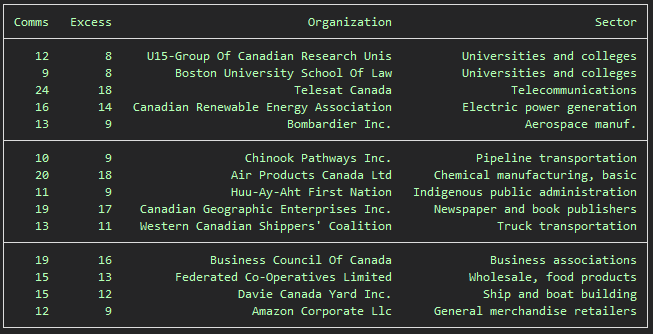

Exhibit 5 lists these ten campaigns, plus another four that did not show up at the sector level because they were offset by lower-than-usual lobbying from other organizations in the same sector. The Comms-column shows the number of communication-filings, and the Excess column shows that number’s deviation from the organization’s expected (i.e. predicted) amount of filings.

The 14 organizations that appear to be pursuing focused lobbying campaigns (ordered by sector as in Exhibit 2) are: Boston University School Of Law (Universities and colleges), U15-Group Of Canadian Research Unis (Universities and colleges), Telesat Canada (Telecommunications), Canadian Renewable Energy Association (Electric power generation), Bombardier Inc. (Aerospace manuf.), Chinook Pathways Inc. (Pipeline transportation), Air Products Canada Ltd (Chemical manufacturing, basic), Huu-Ay-Aht First Nation (Indigenous public administration), Canadian Geographic Enterprises Inc. (Newspaper and book publishers), Western Canadian Shippers' Coalition (Truck transportation), Business Council Of Canada (Business associations), Federated Co-Operatives Limited (Wholesale, food products), Davie Canada Yard Inc. (Ship and boat building), and Amazon Corporate LLC (General merchandise retailers) .

For subscribers who want to take a deeper dive into the data, we recommend LobbyIQ’s platform, which offers data and software solutions for the government relations professionals.

Next week, we will take a close look at which government institutions saw unusually high lobbying communications activity directed their way in August.

Lobbying communication filings need to be reported to the government by the 15th of the next month. Civil servants then take a few days to enter those filings into the public record. By the end of a month, the previous month’s filings are approximately complete. Given this cadence, Queen Street Analytics’ first 3 newsletters in October consider the “last month” to be August, and the 4th newsletter (published at the end of October) considers the “last month” to be September. Restated, the data landscape for August is analyzed in September’s newsletter #4 plus October’s newsletters #1-#3.