The Year in Review: 2023's busiest organizations and sectors

The organizations and sectors that drove government communications in 2023

Welcome to Queen Street Analytics’ first “Year in Review” issue. Over the next couple of weeks, we look at 2023’s most lobbied agencies/institutions and DPOHs, most active consultants and lobby-firms, and most lobbied-on keywords and subjects. Today, we start with 2023’s most lobbying-active organizations and sectors.

CliffsNotes version:

among the most lobbying-active organizations in 2023 were the Environmental Defense Fund, Federation of Canadian Municipalities, Canadian Canola Growers Association, Canola Council of Canada, Centre for Israel and Jewish Affairs, and Canadian Chamber of Commerce

among the organizations with the biggest increases in lobbying activity between 2022 and 2023: The Centre for Israel and Jewish Affairs, Rio Tinto, Telesat, Canadian Pacific Railway, Bombardier Inc., and the Canadian Labour Congress

among the organizations with the biggest decreases in lobbying activity between 2022 and 2023: the Tourism Industry Association, Unifor, the Canadian Medical Association, the Canadian Dental Association, and the Chicken and Dairy Farmers of Canada

at the sector-level, the aggregates are inherently more stable year-on-year, but there were still a few big movers, with Mining and Indigenous stakeholders among the sectors with significant increases in lobbying activity in 2023 relative to 2022.

1. The Most Lobbying-Active Organizations of 2023

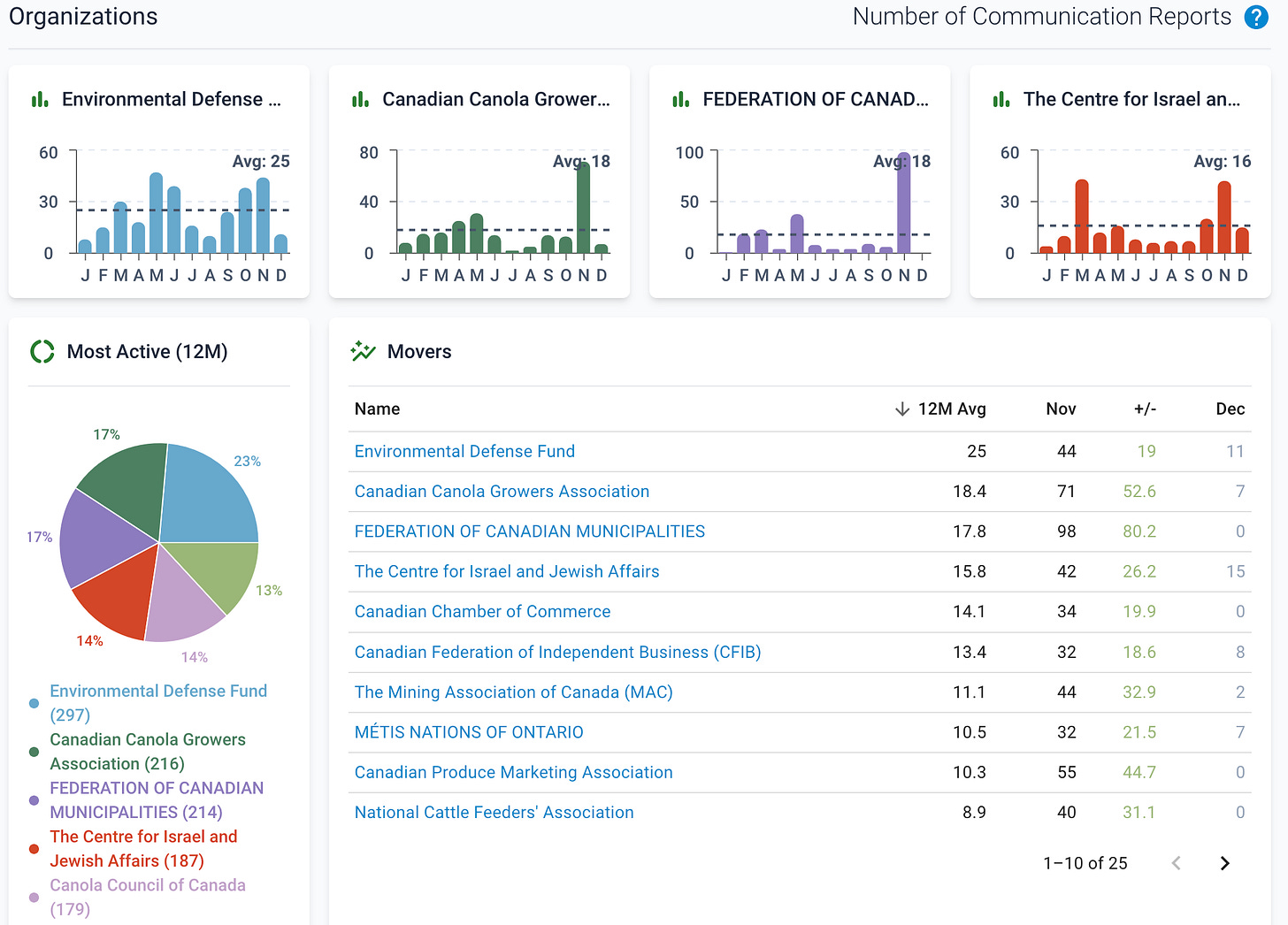

A quick way to get a cursory look at the most lobbying active organizations of 2023 is LobbyIQ's freely available “big picture” dashboard. Exhibit 1 shows a snapshot of the sector-exhibit on that dashboard. Sorted on the 12-month average column (12M Avg) we get a quick view of the 25 most lobbying-active sectors of 2023. At the top of the list, we see the the Environmental Defense Fund, Federation of Canadian Municipalities, Canadian Canola Growers Association, the Centre for Israel and Jewish Affairs, and Canadian Chamber of Commerce, and so on. (The caveat on this exhibit is that it is anchored on monthly moves, which means it does not show lobbying-intensive organizations with low monthly variation; e.g., the Canola Council of Canada, the fifth-biggest lobbying group in the pie-chart on the left, doesn’t show up in the table on the right because it’s recent lobbying was close to its average.)

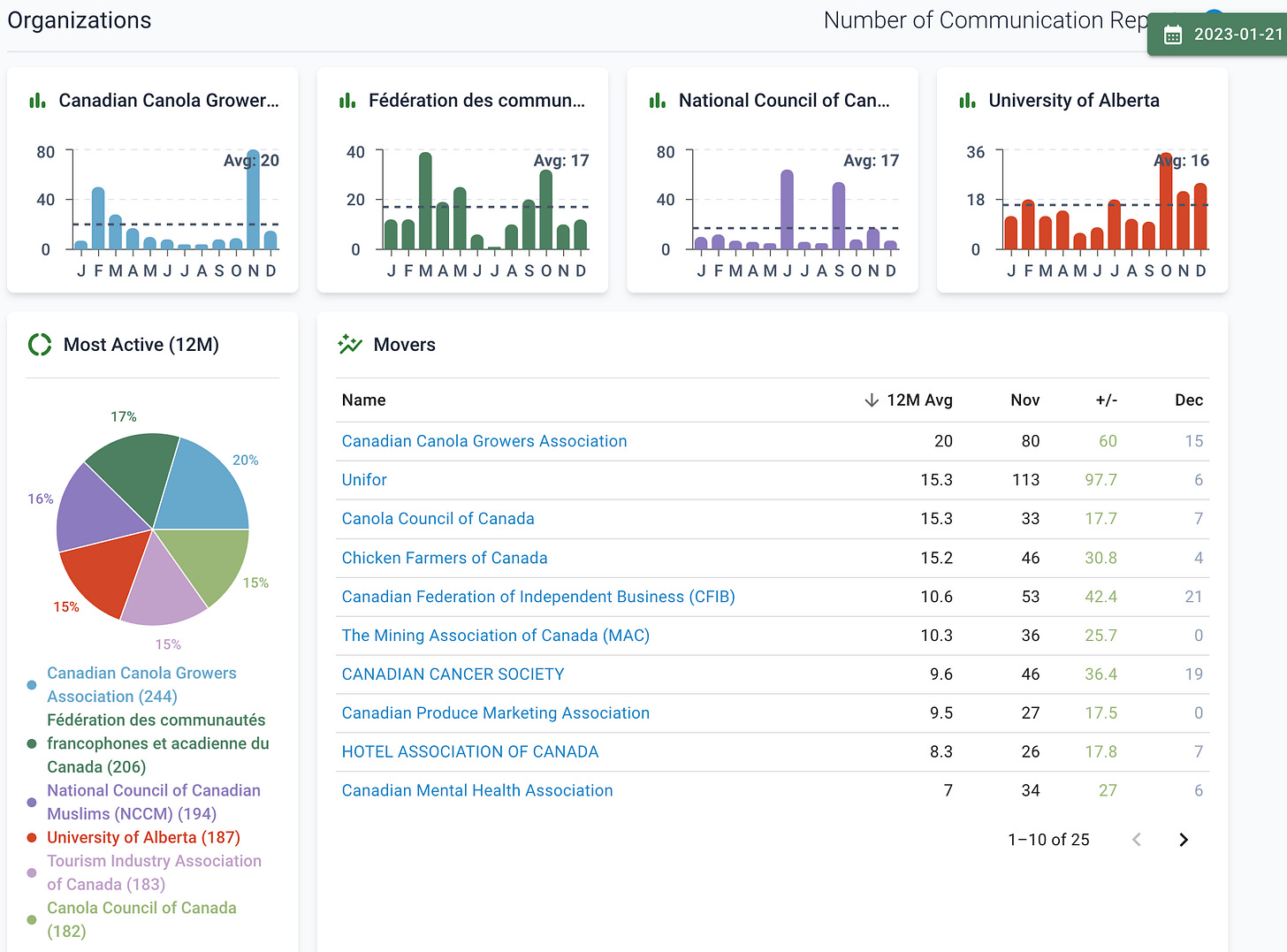

How does this compare to 2022? LobbyIQ subscribers can get a quick answer by setting the Wayback-machine on the “big picture” dashboard back to January 2023, (the green button on the top-right of Exhibit 2) to a snapshot from 12 months ago, resulting in the image in Exhibit 2.

For a more systematic comparison, we list out the top-25 lobbying-organizations in 2023 in Exhibit 3, with their number of filings in 2023, as well as a comparison to their rank in 2022. There are a lot of organizations, especially in agriculture and ranching, that were at the top of the list in both year; but there were also some organizations with big increases in lobbying activity between 2022 and 2023: the Environmental Defense Fund, the Centre for Israel and Jewish Affairs, Telecoms (Telus, Telesat, Rogers), the Canadian Labour Congress, Rio Tinto, Bombardier Inc., etc. Several university-organizations were also considerably more active in 2023, especially out west: U Manitoba is in Exhibit 3, but U Alberta and U Saskatchewan also significantly increased their lobbying activity

What about the biggest relative movers? Exhibit 4 shows the list of 25 organizations with the biggest increases in lobbying activity year-on-year. Mechanically, there is some overlap with organizations in Exhibit 3, but there are also lots of big movers that didn’t make it into Exhibit 3’s overall top-25, including some miners (Ring of Fire Metals), universities (Saskatchewan Polytechnic, U15-Group of Canadian Research Universities) and Indigenous stakeholders (Huu-ay-aht First Nation, the Metis Settlements General Council). BlackBerry, towards the bottom of the list, had a big increase in particularly high-profile meetings at the prime minister’s office (PMO)in 2023.

What about the flipside? Which organizations saw the biggest decreases in lobbying-activity in 2023? Exhibit 5 shows the organizations with the biggest decreases in activity from 2022 (Rank22) to 2023. Amid several organization-specific changes, a few clusters stand out here, including in hospitality ( Tourism Industry Association of Canada, Restaurants Canada, Food and Beverage Canada, and the Hotel Association), heritage media organizations (Canadian Media Producers Association CMPA, and Corus Entertainment), and professional organizations in healthcare (Canadian Dental and Medical Associations).

2. The Most Lobbying Active Sectors of 2023

At a more aggregated level, we can survey the sector-level exhibit on LobbyIQ's “big picture” dashboard, with a snapshot shown in Exhibit 6.

To glean a comparison to 2022, LobbyIQ subscribers can again manipulate the Wayback-machine on the dashboard to populate the equivalent list for 2022. For our purposes in this article, Exhibit 7 shows the comparison in table-form, displaying the top-25 sectors in 2023 (rank-ordered) with their filings and a comparison to their 2022 filings and rank (Rank22).

At the sector-level, things are inherently more stable because of the aggregation, but there were still a few big movers, including Mining (the 7th most active sector in 2023), Indigenous stakeholders (the 10th most active) and Aerospace/Defense, Banking and Pipelines (the 16th, 17th and 18th most active sectors in 2023) among those with significant increases in lobbying activity in 2023, relative to 2022.

This concludes today’s issue. Next week, we will look at 2023’s the most lobbied agencies/institutions and DPOHs.