Each month, Queen Street Analytics publishes four reports on the government relations landscape in Ottawa, analyzing noteworthy patterns across (#1) the most lobbying-active sectors and organizations, (#2) the most lobbied government institutions and public officials (DPOHs), (#3) the most active lobby-firms and lobbyist-consultants, and (#4) the most lobbied-on and discussed subjects and keywords. Our approach is not journalistic and we don’t report on anecdotes or on the news cycle. Instead, we use statistical and machine-learning enabled analytics to uncover patterns, trends, and opportunities, giving our subscribers an enhanced toolkit to navigate the government relations landscape.

In our newsletter#3 we look at last month’s top-consultants and lobby-firms.

The CliffsNotes version:

In October, there were 2773 filings associated with 593 in-House registrations, and 1109 filings associated with 548 external registrations

PAA Advisory is topping the firm-leaderboard for filed communications in October with 134; with Sussex Strategy and Counsel PA coming in second and third.

There were 29 consultants with 10 filings or more. The communications-leaderboard is topped by Dan Lovell (Sussex Strategy) and Tom Potter (Blackbird Strategies), each with 20+ filings.

There were 15 lobby firms with 3+ new registrations in October; a list dominated by PAA Advisory and Crestview Strategy.

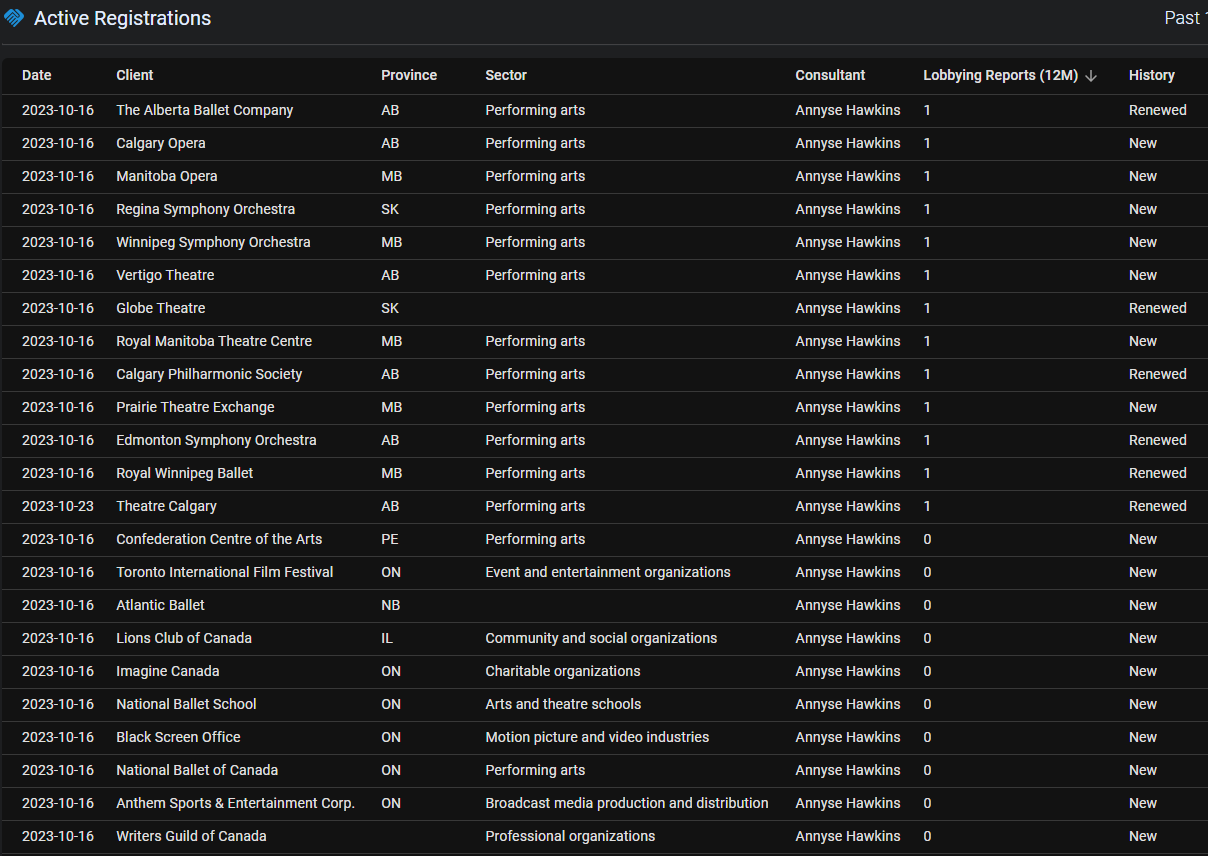

PAA’s Annyse Hawkins crushed the consultant-leaderboard for new registrations in October, with 22 new registrations, disproportionately drawn from one particular sector of the economy.

1. Lobby-Firms’ and Lobbyists’ Communication Leaderboards

As of November 20th, October shows there were 2773 filings associated with 593 in-House registrations, and 1109 filings associated with 548 external lobbyist-consultant registrations. This makes October a busy month. By comparison, the September data showed 1709 in-House communications and 810 communications involving consultant lobbyists.

Exhibit 1 shows the number of communication filings in October and September. PAA Advisory, Sussex Strategy and Counsel PA top the leaderboard.

The surprise package in October is Blackbird Strategies, a firm which Exhibit 2’s snapshot from LobbyIQ's lobby-firm dashboards shows as 15th on a twelve-month rolling basis, but which came in at fourth for this month.

Which individual lobbyists drove communication filings activity?

Exhibit 3 shows the individual consultants’ leaderboard for October/September 2023, topped by Dan Lovell at Sussex and Tom Potter at Blackbird. Potter in particular really drove Blackbird’s overall activity in Exhibit 1.

Interestingly, two independents make the list in October, Bilal Cheema and Scott Thurlow, reaffirming the point we have made lately that there always seems to be room for smaller consultant firms to carve out their niche in Ottawa’s GR landscape. By comparison, our U.S. sister publication K Street Analytics shows that the Washington DC lobbying industry is much more top-heavy, with five firms filing more than 10 million USD in lobbying income last quarter.

2. Lobby-Firms’ and Lobbyists’ Registration Leaderboards

Which lobby firms and consultants secured the most new registrations last month?

To answer this question we are careful to exclude simple registration-renewals, and to not double-count multiple registrations per firm-client pair (i.e. when several individual consultants’ file separate registrations).

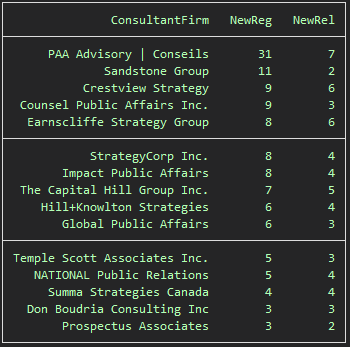

Exhibit 4 shows October’s leaderboard, listing the number of new registrations (NewReg) as well as the number of truly novel relationships, i.e. where there was not already a previous registration between a client and another consultant at the same lobby-firm.

PAA Advisory tops the list for both new registrations and new relationships, reaffirming its current position as Ottawa’s largest GR firm at the present moment. Crestview Strategy, Ottawa’s second-largest GR firm by communications and active registrations, also added several new relationships to their portfolio, while Sandstone’s new registrations primarily deepened their relationships with existing clients (NewRel was only 2).

Exhibit 5 breaks out the new relationships that were only aggregates in Exhibit 4. (The last column indicates when multiple consultants filed registrations for the same firm-client relationship.)

Lastly, Exhibit 6 breaks out Exhibit 4’s new registrations by consultants. PAA’s Annyse Hawkins had a breakout month in October, registering 22 new clients under her name (although we know from Exhibit 4 these were mostly existing relationships from PAA’s point of view). Hugues Théorêt and Shawn Driscoll at Sandstone come in at joint second with 9, and there were twelve other consultants who secured three or more new registrations.

LobbyIQ’s consultant-dashboards provide a quick way to take a deeper dive into the individual consultants’ activity, including the sectors that clients were drawn from. For example, Exhibit 7 shows that Annyse Hawkins’ leaderboard-topping October registrations were disproportionately drawn from her deep engagement with clients in the various arts.

In next week’s fourth monthly newsletter for November, we leverage LobbyIQ’s machine-learning and AI-enabled text analytics to characterize the “themes” that drove lobbying as well as parliamentary discussions in Ottawa last month.

Please share if you enjoyed this newsletter.