Ottawa's most lobby-active organizations and sectors in November

Crop producers, miners, and the performing arts

Today, we are making a small but potentially confusing change to our newsletter sequence: until now, our four weekly issues in a calendar month were sequenced like this:

most lobbying-active sectors/organizations

most lobbied agencies/DPOHs (next week’s issue).

most active lobby-firms/consultants

most discussed issues/subjects

When we created this sequence, we did not originally consider that the vast majority of lobby-communication filings get reported in the middle of the (next) month. So far, this has meant issues 3 and 4 above were the first to report on new updated data. For example, November’s issue 3 was the first issue to report on October data, and so on.

Starting with today’s issue, we are changing this sequence because we want to prioritize which topics we give data-updates on first. This means that going forward, the issues in a calendar months are sequenced so that the most lobbying-active sectors/organizations and most lobbied agencies get updated first, hence the new sequence:

most discussed issues/subjects

most active lobby-firms/consultants

most lobbying-active sectors/organizations (today’s issue)

most lobbied agencies/DPOHs (next week’s issue)

Without further ado, let’s get into today’s issue on the sectors and organizations that stood out in their communications activity in November.

The CliffsNotes:

There were just over 4,000 communications filings last month, around 15% more activity than predicted by our baseline trend/cycle model. In short, November was a surprisingly busy month in Ottawa

Most prominent among the sectors with unusually high lobbying activity were crop producers, miners, business associations, indigenous stakeholder groups, and the performing arts

There was a whopping 42 organizations with focused communications campaigns in November (10+ filings in excess of their usual patterns), including the Metis Settlements General Council, Environmental Defense Fund, Google Canada, the Association Of Canadian Publishers and News Media Canada, the Centre For Israel And Jewish Affairs, and the National Cattle Feeders' Association

For comparison, check out our last issue on this topic here:

1. Unusual Lobbying Activity in November

There were just over 4,000 communications filings last month, around 15% more activity than predicted by our baseline trend/cycle model. In short, this November was an unusually busy November in Ottawa.

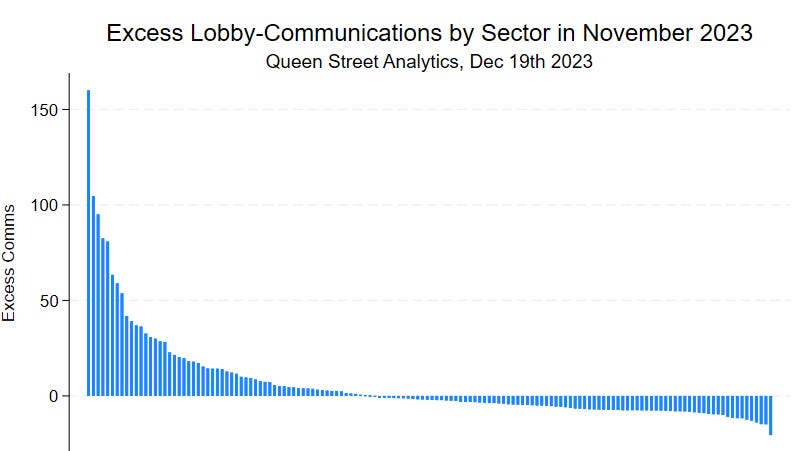

To identify breakout sectors, we count filings by sector-month-pair, and run a prediction model with separate shifters for each sector (creating a panel of 150 sector-specific monthly time-series). Exhibit 1 charts the difference between actual and predicted number of filings in September, rank-ordered left-to-right across the 150 sectors. The biggest positive breakout is +160 more communication filings than predicted (far left), which turns out to be in crop production. Negative outliers on the right reflect sectors with unusually muted activity.

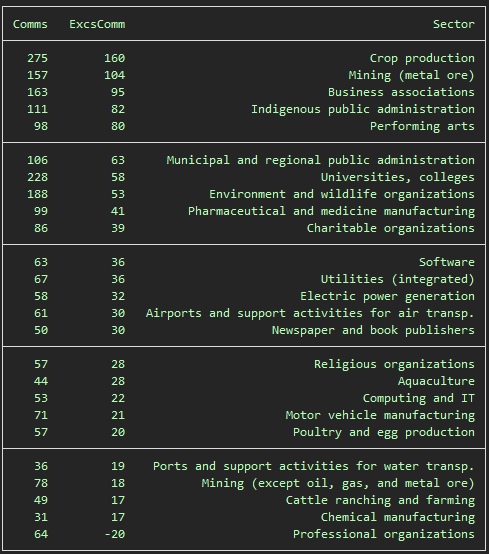

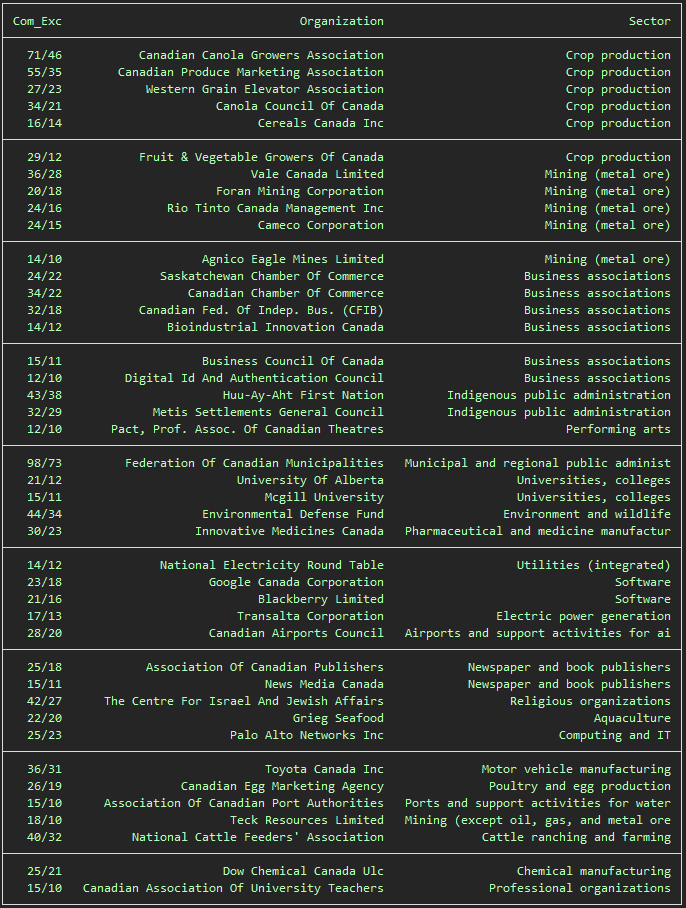

Overall, there were 19 sectors with 18+ excess lobbying filings. Exhibit 2 lists these outliers, which are, in order: Crop production, Mining (metal ore), Business associations, Indigenous public administration, Performing arts, Municipal and regional public administration, Universities, colleges, Environment and wildlife organizations, Pharmaceutical and medicine manufacturing, Charitable organizations, Software, Utilities (integrated), Electric power generation, Airports and support activities, Newspaper and book publishers, Religious organizations, Aquaculture, Computing and IT, Motor vehicle manufacturing, Poultry and egg production, Ports and support activities, Mining (except oil, gas, and metal ore), Cattle ranching and farming, Chemical manufacturing, Professional organizations.

Column 1 in Exhibit 2 shows communications filed, and column 2 shows the deviation from the number of communications predicted by the usual sector-month patterns.

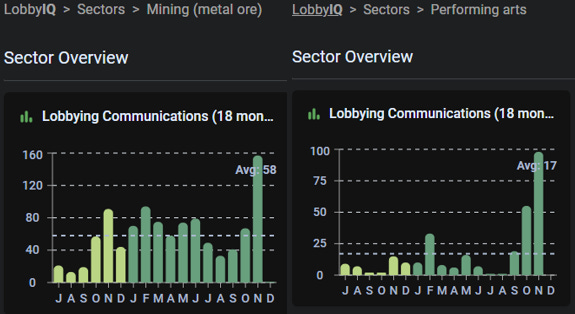

For a bit of eye-candy, Exhibit 3 shows outliers #2 and #5 (mining, and the performing arts) on their respective sector-dashboards on LobbyIQ, where we can more visually see how November was a break from trend.

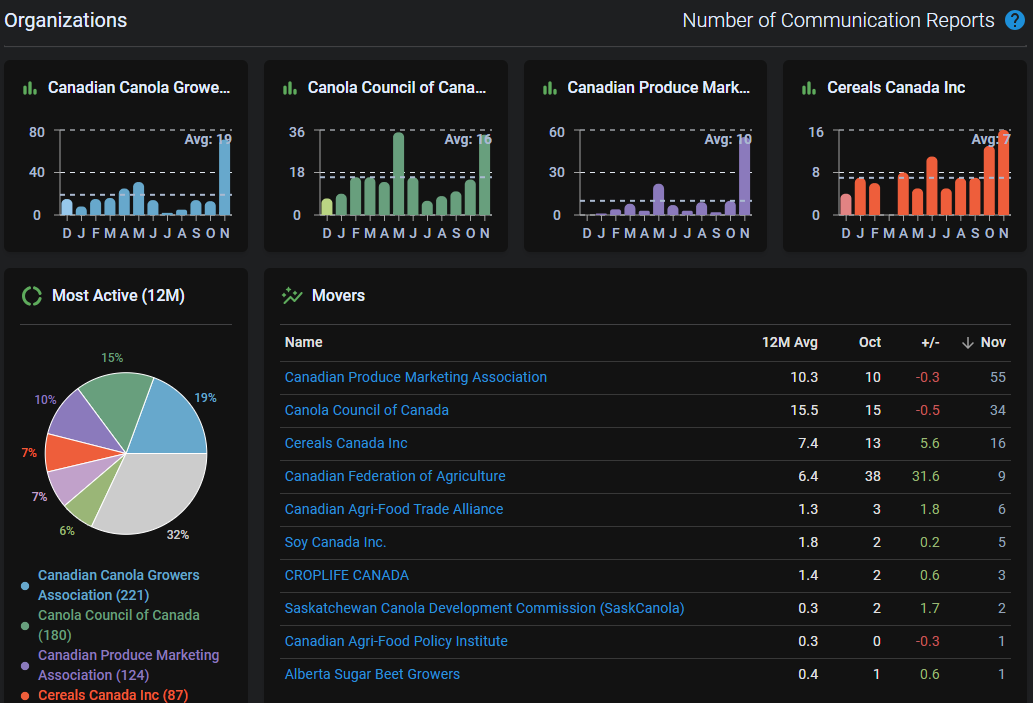

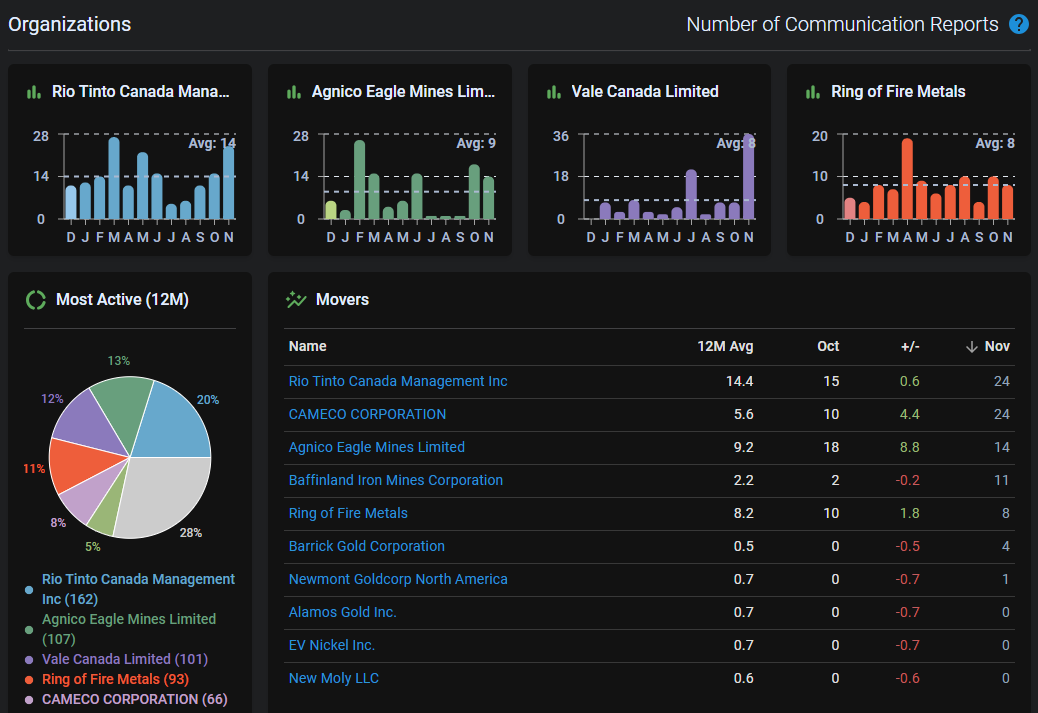

Many (not all) of the breakout lobbying-patterns in Exhibit 2 are driven by the focused communication efforts of specific organizations in each sector. LobbyIQ’s sector-dashboards provide the quickest gauge for finding focused communication efforts. For example, Exhibits 3 and 4 show snapshots of the organization-clusters on LobbyIQ’s crop-producers dashboard and mining dashboard, and in each case the November column on the right shows some big outliers.

2. Organizations’ Communications Campaigns

To be more systematic in identifying focused lobbying campaigns by individual organizations, we fan the communications-data out into a panel of several thousand organization-specific monthly time-series, and look for breakouts from the predicted number of communications at the organization-level. This shows us which of the sectors with unexpectedly high communications in Exhibit 2 can be accounted for by focused communication campaigns by one or two organizations.

Exhibit 5 lists a whopping 42 organizations that had at least nine monthly communications more than predicted by our model (sorted as in Exhibit 2 to make for easy comparison). The first column (Com_Exc) reports on the number of communication filings relative to the excess (over predicted) number of filings.

In many cases, the sector-level outliers in Exhibit 2 can be traced back to a handful of organizations. e.g:

crop producers: Canadian Canola Growers Association , Canadian Produce Marketing Association, Western Grain Elevator Association, Canola Council Of Canada, Cereals Canada Inc, Fruit & Vegetable Growers Of Canada

miners: Vale Canada Limited, Foran Mining Corporation, Rio Tinto Canada Management Inc, Cameco Corporation, Agnico Eagle Mines Limited

Bus assoc’s: Canadian Chamber Of Commerce, Saskatchewan Chamber Of Commerce, Canadian Fed. Of Indep. Bus. (CFIB), Bioindustrial Innovation Canada, Business Council Of Canada, Digital Id And Authentication Council

Indigenous stakeholders: Huu-Ay-Aht First Nation, Metis Settlements General Council, etc..

However, there are also sectoral outliers in Exhibit 2 that don’t show up in Exhibit 6; for example the performing arts, where, it turns out, there was a wide-ranging increase in lobbying last month across dozens of organizations. We don’t know what’s going on in the performing arts right now, but it’s interesting to note that our last issue on lobby-firms showed the biggest outliers in new lobby-registrations were also concentrated in the performing arts.

Exhibit 6 also shows that the classification of organizations by sector, while often useful for seeing patterns, is not the only way to organize how we look at lobbying activity. For example, November’s lobbying activity by Google (classified as a Software company) was clearly connected to the lobby filings by the Association Of Canadian Publishers and News Media Canada (classified under Newspapers), with all three organizations pre-occupied by Bill C-18 (the Online News Act). However, Exhibit 6 could not indicate this to us. Incidentally, the final outcome of the recent regulatory actions in Canada have been viewed as a major win and welcome reprieve for Google, at the same time that they took a major regulatory/legal loss in the US, related to their App Store and Epic Games lawsuit.

In next week’s issue, there will be additional GR insights to come on C-18, Google, and the Canadian legacy media, when we take a look at the government agencies and public officer holders that saw unusual lobbying communications activity in November.